Uber, And 5 Other Overvalued Companies

At Recode’s Code Conference a few weeks ago, Uber CEO Travis Kalanick hinted at a new funding round that would be “record-breaking”. Raising $1.2 billion at an $18 billion valuation, Uber delivered on that promise with its latest funding round.

As of December though, Uber was only pulling in around $20 million per week, of which it kept 20%. Their investors are counting on high growth, which I’m skeptical about, but they’re far from the most overvalued company. Here are five App-bubble companies that I think are completely overvalued (in no particular order)

Note: I’m not saying that these companies are overvalued any more than the market is. Venture capitalists have been able to raise much more than ever before from investors, and they’re putting that capital to work. All I’m saying, is that, even for future valuations, I find these valuations a bit questionable.

Which of these companies do you think are fairly valued? Tweet your opinions with the hashtag #fairmarketvalue

1. Uber ($18 Billion): Uber’s still got serious kinks to work out. The model works well in cities, but they still have to figure out how to scale it out of urban areas. Taxi drivers are lobbying governments around the globe, looking to put them out of business. In order to compete, they’re forced to subsidize rides, and cut prices, in order to attract business. In January, they cut prices by nearly 33%. They’re very successful, but they’re taking a lot of risks, and travelling on a very uncertain path.

2. Evernote ($1 billion): Evernote is just an app. Yes, they have over four million paid customers, but they also have 90 million free users that they must support. Building and scaling a cloud-based service like Evernote is now more affordable than ever, but that doesn’t mean it’s profitable. Evernote has major competition, namely from the preinstalled notetaking apps on smartphones, and this thing called a “Post-it-note”. I think that one day, Evernote could be a billion dollar company, but I think it’s ambitious to value it at $1 billion now, given where it’s at. It’s certainly a more justifiable valuation than Whatsapp, but I still think it’s high. CEO Phil Libin wrote an interesting piece pondering his own valuation.

3. Whatapp/WTF ($19 billion): If there ever was a deal that faced universal skepticism, it was Facebook’s acquisition of messaging service Whatsapp for $19 billion. Sure, they have 500 million users (not shabby), but they don’t collect enough data on those customers for it to be useful. This valuation is mostly outrageous simply because no one seems to know why Facebook thought this was a worthy investment. Maybe Zuck has something diabolical and genius planned? That’s what Deloitte thinks is happening.

4. Spotify ($4 billion+): Spotify has 10 million paying users. The issue, once again, is that they have to pay for 30 million free users. They have to pay royalties, and deal with an antiquated music system. Spotify has done a great job acquiring customers, and navigating the musical landscape. I’m a big fan of CEO Daniel Ek, and the way he operates, and his integrity. I simply don’t believe Spotify is worth $4 billion in its current state.

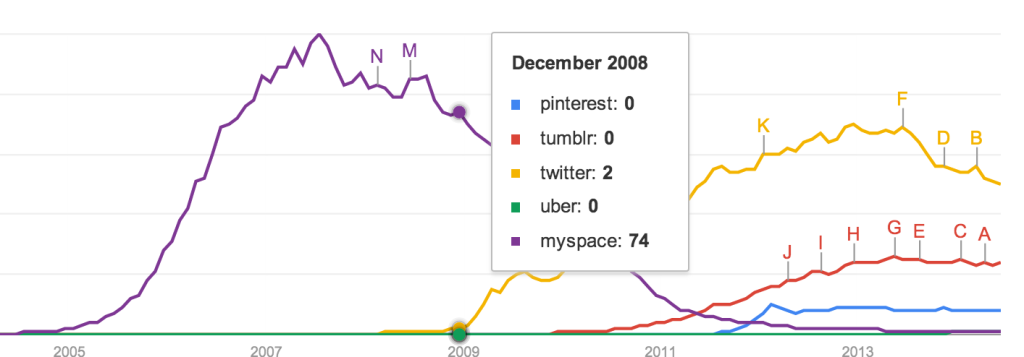

5. Pinterest ($5 billion): Oh great! Another social network. Social networks come and go constantly. The first issue is that users don’t last. Users lose interest in the service, and leave for a competitor. The success of a social network – because it’s so advertising based – is entirely based upon the size and activity of its userbase. $5 billion is actually a reasonable valuation for now, but I think that within five years, Pinterest will be about dead. As you can see in the trend graph below, it’s peaked! It’s caput!

6. Snapchat ($4 Billion): This is another “next-big-thing” that is already fading, if only slightly. Snapchat saw tremendous growth and success, but it’s severely flawed. There are very few unobtrusive ways to monetize the platform. It’s expensive to operate. People will get bored of it, and it’s difficult to expand. Snapchat is far from dead now, but unless they can seriously innovate and iterate, they will eventually fade to dust, like Myspace, Friendster, and Zynga.

5,000 People Value our articles.

[mc4wp_form]